Score

Type

Fiat

KYC

Fees

Founded

FAQ

Apps

Score

Table of Contents

Fixedfloat.com Quick Facts

- Fixedfloat has its own Lightning Network node (most of exchanges haven’t)

- According to their blog, FixedFloat completed more than 1,000,000 orders in 2022

What is FixedFloat?

Speed, Convenience, and Security. These are the three main qualities of FixedFloat, a rapidly growing cryptocurrency exchange that’s been gaining popularity in the cryptocurrency community. FixedFloat was created by a team of experts that have extensive knowledge and experience in blockchain, finance, web technology, and entrepreneurship. Together, they’ve created a fully automated digital asset exchange in the lightning network that offers customers fast processing and favorable exchange rates, without the hassles of signing up or logging in to an account.

FixedFloat features

As more opportunities are created through the rise of cryptocurrencies, companies have to have a particular competitive advantage over their competitors. With FixedFloat, users enjoy several features designed to help them maximize their profits when trading digital assets. Here are a few examples:

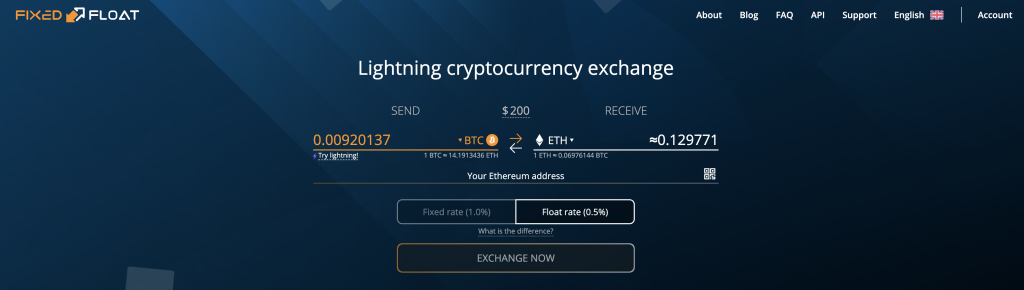

- User-friendly interface: What usually prevents beginners from diving deeper into cryptocurrencies is that the interface of most exchanges tends to overwhelm them with information right on the exchange’s homepage and complicated trading process. With FixedFloat, users can trade pairs immediately from the homepage and the design is intuitive enough that even beginners can get started on their own.

- To start a trade, users just have to select the coin and the amount they want to exchange in the “Send” field.

- Choose whether fixed or float rate, select the coin they want to receive under the “Receive” field, and enter the wallet address to which they will receive the coin.

- Lastly, click the “Exchange” button and the digital assets would then be sent to the wallet address specified by the user.

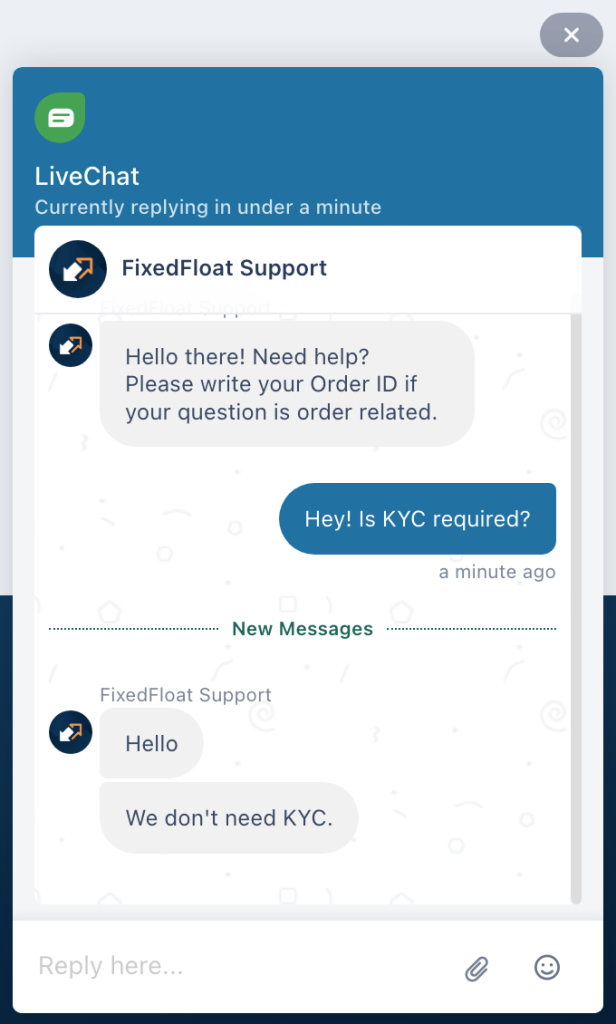

- Security: FixedFloat is a noncustodial cryptocurrency exchange. This means that it does not store the user’s funds or keys. Moreover, the exchange only uses hot wallets which ensures maximum security. In addition, FixedFloat gives importance to its user’s anonymity, thus, it doesn’t require any KYC (know your customer) registration. This further improves user convenience since they can skip the usual sign-up process that most exchanges have.

- Speed: FixedFloat boasts of its fully automated exchange that lets users save time with the platform’s fast transaction processing that allows users to quickly and efficiently make a trade. This can help users take advantage of market fluctuations and capitalize on profitable opportunities.

- Lightning Network: The platform also supports Lightning Network, a Bitcoin Layer 2 solution that’s capable of millions to billions of transactions per second, low-cost and fast blockchain payments, and cross-chain transactions without third-party custodians. This allows users to make Bitcoin transactions instantly and with low fees.

- Supported currencies: The exchange supports popular currencies such as Bitcoin Ethereum, Tether, Litecoin, and Monero. For a full list of the supported currencies, click here.

- Cross-platform: The platform works seamlessly on any device giving users the flexibility to manage their assets and make trades anytime they want to.

- Customer Support: One feature that builds confidence and trust between users and exchanges is having reliable customer service. FixedFloat emphasizes this service to the point that they have 24/7 customer support through live chat. The team can also be contacted through the following:

- Twitter: @FixedFloat (estimated reply time: 24 hours)

- Telegram: @FixedFloat (estimated reply time: 10 minutes)

- Instagram: @fixedfloat

- Email: [email protected] (estimated reply time: 24 hours)

FixedFloat Fees

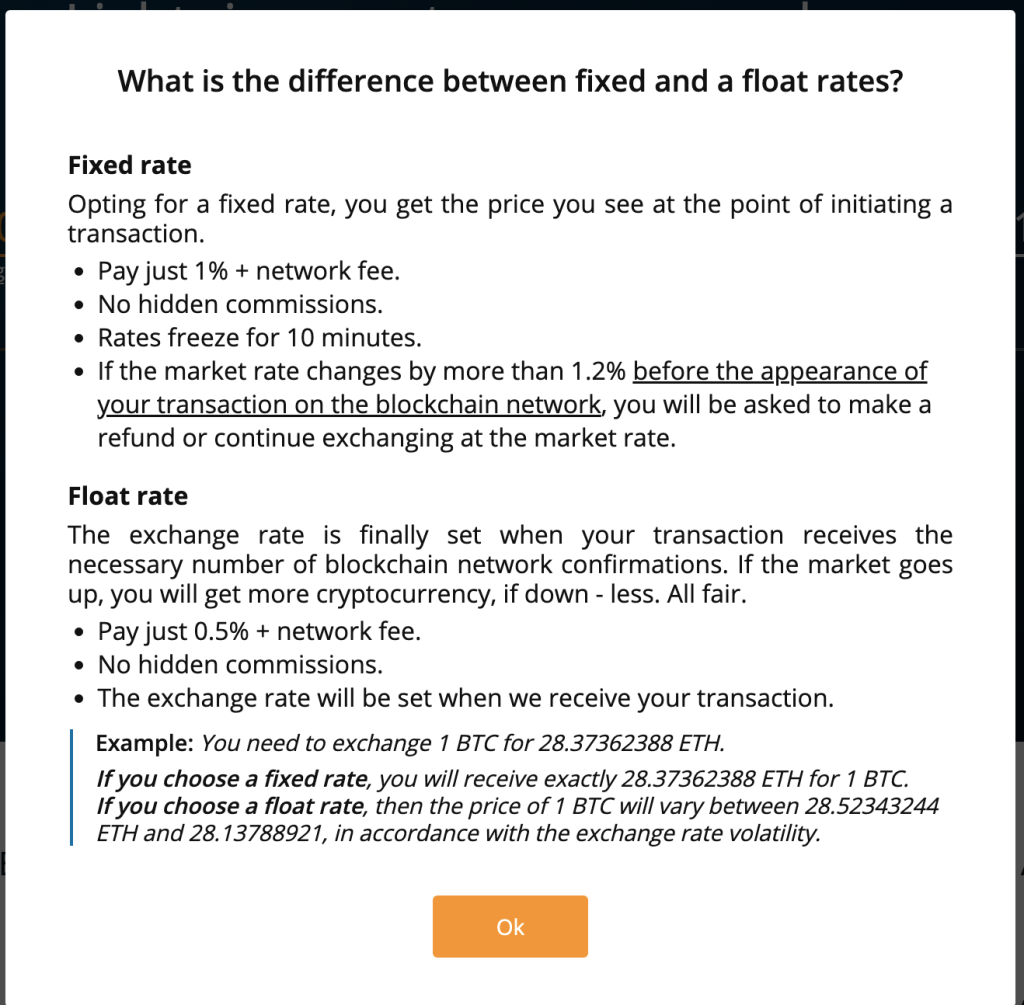

The fees an exchange charges are one of the important features that users first look at when choosing a platform. This is because high fees can significantly reduce the profits they can make. With FixedFloat, can choose between fixed and float rates.

- Fixed rate – when users opt for a fixed rate, they’d get the price stated once the transaction is initiated.

- Users are charged 1% on top of the network fee

- Float rate – when users opt for a float rate, the fee would vary depending on the volatility of the market

- If the market goes up, users will receive more assets. But if the market goes down, they’d receive less

- Users are charged 0.5% on top of the network fee

Keep in mind that the network fee depends on the blockchain network and is beyond the control of FixedFloat

FixedFloat KYC

As stated earlier in the features section, FixedFloat does not require users to go through a KYC (know your customer) process. This means that users don’t have to provide any personal information to proceed with their transaction, which allows users to maintain their anonymity. However, users may opt to register for an account if they want to keep track of their transactions.

FixedFloat Pros and Cons

Pros

- Intuitive and user-friendly interface

- Fast transaction speed

- Cross-platform feature

- Low fees

- No KYC required

- Affiliate Program

Cons

- A limited number of cryptocurrencies supported

- FixedFloat does not offer services to U.S. citizens